The technology sector may be seen by the stock market as the hotbed of growth and the rally's main driver, but Jim Cramer wanted to put its performance into context.

"It's not like tech is vaulting into the stratosphere while everything else does nothing," the "Mad Money" host said. "What we have here is a broad-based rally that's taking up all sorts of stocks, proving once again that diversification is the only free lunch in this business."

In the last six months, the tech stocks in the rallied 15 percent on average, but the health care stocks rose over 13 percent, with industrials, materials and financials up 8 percent.

So Cramer used the charts of technician Bob Moreno, publisher of RightViewTrading.com and Cramer's colleague at RealMoney.com, to highlight some of the overlooked sectors' top names.

Energy: XOM

Cramer began with the daily chart of Exxon Mobil, which Moreno said tends to be a good proxy for the oil patch.

Since oil has been trading in a tight range of late, Exxon's stock has been too, but Moreno noticed that every six weeks, the stock bottoms, then pushes up against its ceiling of resistance before declining again.

Based on this activity, Moreno said Exxon has established a bottom around $80, and having just made another cyclical low in early July, the stock could have more upside for the time being.

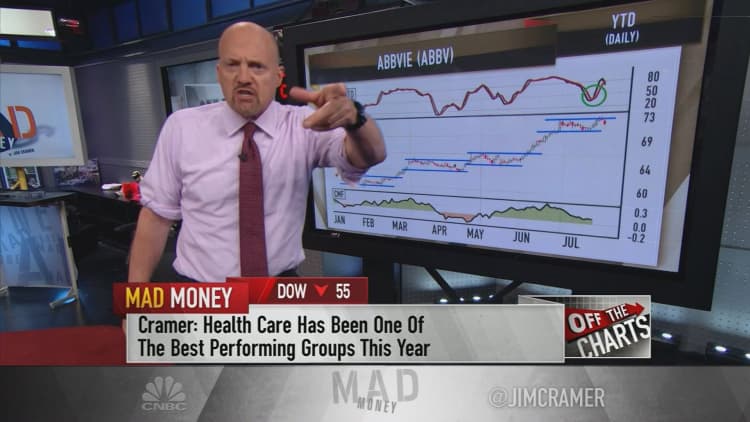

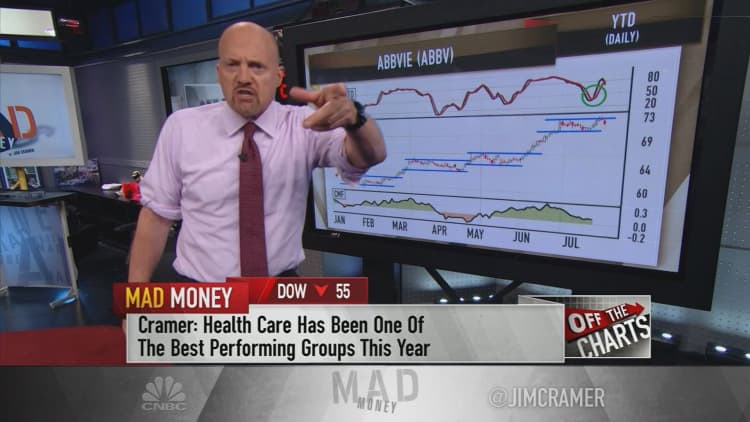

Health Care: ABBV

To get the vitals on health care, Cramer used the daily chart of pharmaceutical player AbbVie, which has been climbing higher by trading sideways, rallying quickly, then repeating the pattern.

Last week, AbbVie's stock dipped to the low end of its range before bouncing back, and although it has since pulled back from those highs, Moreno said it could have more room to run higher.

The technician based this on the action in the stochastic oscillator, a tool that shows when a stock has gotten overbought or oversold. He saw it making a bullish crossover, where the black line in the above chart goes over the red line.

"At the same time, the Chaikin Money Flow [oscillator] ... measures the level of buying and selling pressure in a stock and is still in very positive territory, suggesting that the big boys continue to accumulate shares in AbbVie," Cramer said. "Put it together and Moreno believes that this rally is not finished."

Consumer Discretionary: PCLN

In looking at the daily chart of Priceline.com's stock, a solid tracker of discretionary spending on travel and leisure, Moreno noticed that it has been trading in an ascending triangle pattern under the $1,920 level for the last two months.

Last week, the stock pushed through its ceiling of resistance and has been running higher, and based on several indicators, Moreno believes the stock could start its uphill climb again.

Financials: BX

For the relatively hit-or-miss financial sector, Cramer turned to the daily chart of one of its best performing stocks, Blackstone.

The asset manager's stock has been red-hot so far this year. Moreno said the technical indicators are all sending bullish signals, and thinks the stock can continue to soar.

Industrials: HON

The "Mad Money" host turned to the chart of Cramer-fave Honeywell to track the industrial sector. After rallying higher for months, Honeywell's stock is incredibly close to an all-time high.

Moreno noticed that the money flow index, a momentum indicator based in part on trading volume, made a sharp upturn recently, meaning big institutions are buying into Honeywell. That suggests its long term upward trend will continue.

Final Thoughts

Despite the market's obsession with tech, Cramer noted that lauded names like Facebook and Microsoft are far from the only ones that have recently made it onto the new-high list.

"When you take a broader look at the whole market, you can find all kinds of big household name stocks that are working here, stocks that have nothing to do with tech," Cramer said.

In reality, Moreno's charts of Honeywell, Priceline, Blackstone and AbbVie are signaling full steam ahead for their stocks, Cramer said.

"Heck, that's enough stocks for a diversified portfolio right there — and he even thinks Exxon, in the most hated part of the market, the energy space, could be due for a bounce," the "Mad Money" host added. "In other words, don't let the tech rally blind you to everything else that's going right. There's too much good happening right now."

Watch the full segment: Cramer goes off the charts for buys

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com